July 26, 2022

Welcome to the 2022 edition of Law 365’s Microsoft Partner Insights.

We teamed up with Incredible Results, analytics and data management experts Coeo and organisational development specialist and psychologist Emily Frohlich to conduct our third year of research in to a key group UK Microsoft Partners….. what has the last year been like for them? What have been the main drivers for growth? What opportunities and threats do they see on the horizon?

We report on the drivers and metrics behind these Partners so you can benchmark your business against your peers.

Key themes for 2022

- Economic headwinds – Rising wage inflation

- Intellectual property – Is it on your radar, and if not why not?

- Recruitment - The War for Talent

- Employee retention –Prioritising employees & embracing flexibility

- Diversity and inclusion – A passive or purposeful approach?

- Office space – To have or not to have? That is the question.

About the research and participants

We asked over 50 of the UK’s top Small and Medium-sized Enterprise (SMEs) Microsoft Partners to participate in this year’s research. The group invited was a mix of the networking group IT Leaders and Law 365’s own clients.

The IT Leaders group

Law 365 clients

.png?width=700&name=microsoft-partners-half-block1%20copy%20(1).png)

As in previous years, the research conducted was a mix of quantitative, which took the form of a 50+ question survey, and qualitative, involving a lengthy 1-to-1 interview with the C-level leaders of the participating Microsoft Partners.

Where possible we have included direct quotes from the CEO's we interviewed.

The cohort encompassed the full spectrum of SME Microsoft Partner profiles, from size and type of business to ownership structure and Microsoft solution specialism.

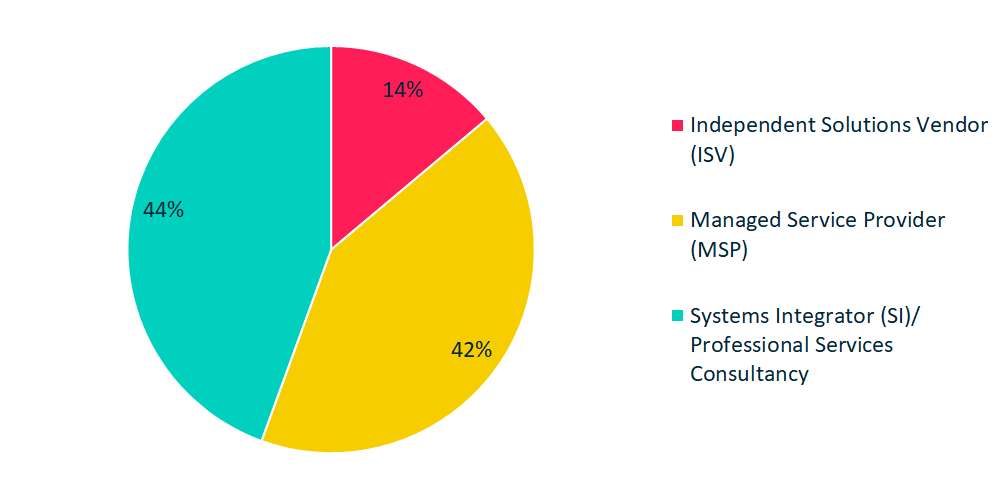

In line with last year’s results Managed Service Providers (MSP) and Systems Integrators (SI)/ Professional Services Consultancies formed the majority of the group accounting for 86% of participants, compared with 84% of participants last year.

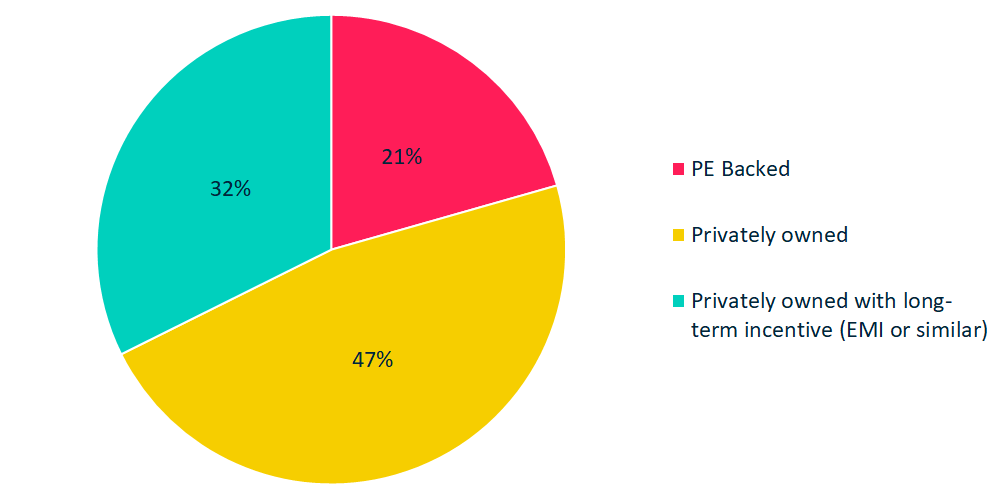

Ownership structure

Just over two-thirds (68%) of the Microsoft Partners involved are privately-owned or privately-owned with an Enterprise Management Incentive (EMI) scheme. This is slightly down from last year where this category accounted just over 70% of the group, and is representative of a small change in research participants this year, as well as the continued consolidation within the Microsoft Partner sector through acquisitions. This consolidation of Partners in the market is also reflected in the increased number of Private Equity backed participants this year. This number doubled – to 21% from 11% last year.

In fact, it has been a record year for M&A activity globally with data analytics company GlobalData reporting that “total deal volume jumped up 38% year-on-ear (YoY)”, and that “technology, media, and telecom (TMT) continued to be the biggest sector in terms of both M&A deal value and volume—with 12,585 deals worth $1.27tn recorded in 2021.”

“It feels like 2022 will be breakthrough year for us. Our ownership will change a bit as we will exit some minority shareholders and bring new ones in to fund our next period of growth.”

Headcount

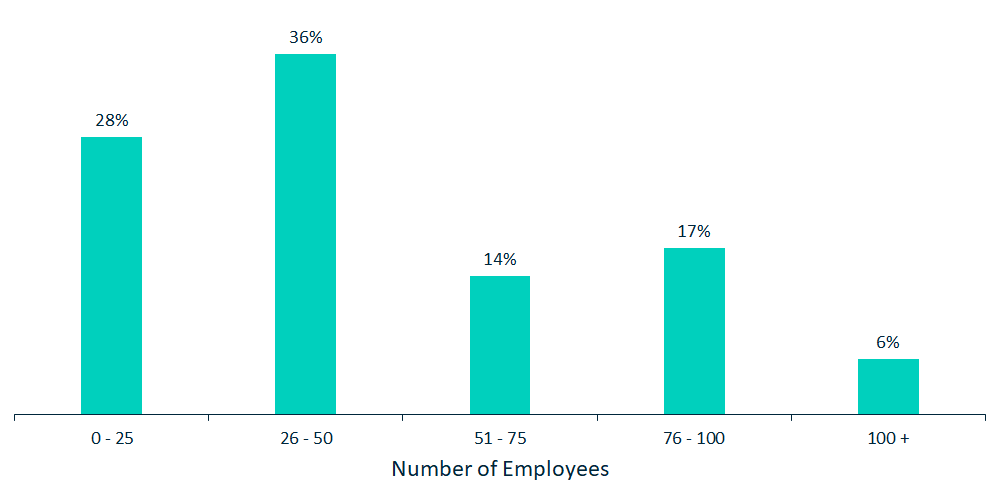

When categorising the Microsoft Partners by headcount the most common company size was the 26-50 employees bracket which accounted for just over a third (36%) of the cohort. The composition of the group in this respect was largely unchanged with 78% of companies under 75 employees, compared with 84% last year.

Total company headcount

There was a notable shift in the 76 to 100 employees bracket, which increased significantly, from 3% to 17%, offsetting the drop in the largest SME partners (100+ employees) which fell from 14% last year to 6% in 2022.

Long term ambitions

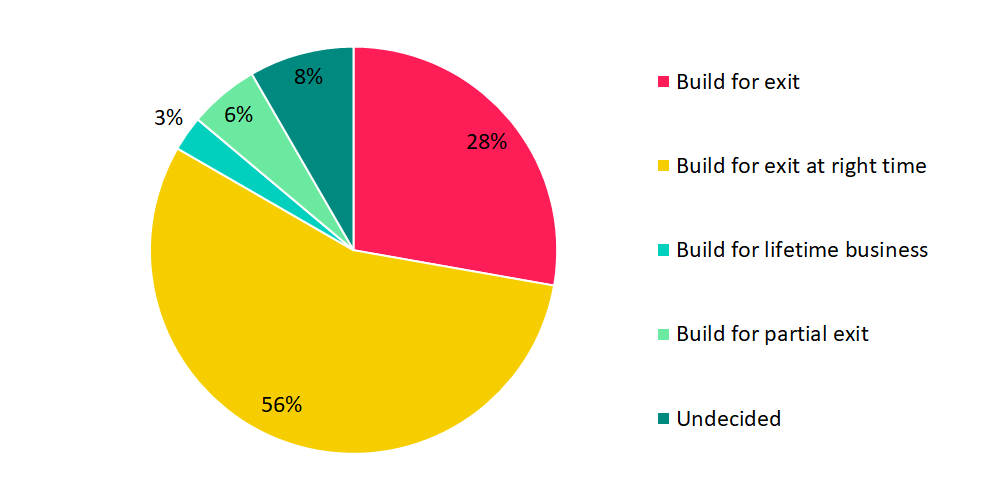

Given the incredible growth in the UK tech sector in the last 24 months and the resulting exponential increase in UK tech firm valuations, it is unsurprising to see that ‘building for exit’ featured heavily as a response to questions on leadership ambitions from the CEOs interviewed.

Leadership Ambitions

In fact ‘building for exit’ in one form or another accounted for an incredible 90% of the responses. This compares with 68% of respondents at the same time last year.

The UK’S Digital Economy Council reported recently that the UK tech sector was valued at, “$446 billion in 2018, but is now valued at $942 billion after growing 42% between 2020 and 2021.” The growth in valuation is attributed to, “greater investment into software and digital companies at the start of the pandemic.” In fact, the UK tech sector is currently worth over $1 trillion, a valuation that only China and the US have achieved.

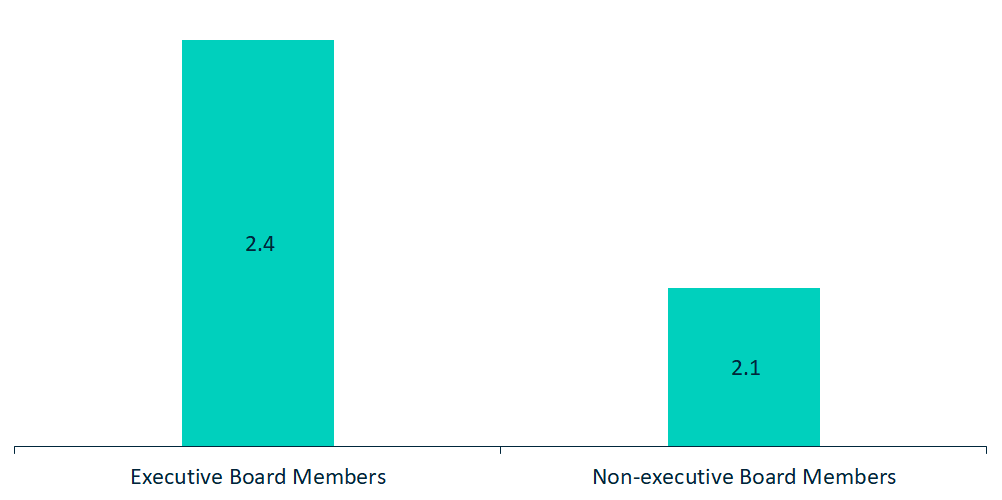

The Boardroom

They say it can be lonely at the top, so we were interested to find out more from the leaders about the structure of their Board. The average number of Executive Board members was 2.4 with non-exec members taking an average of 2.1 seats. The maximum we found was 7 for exec and 5 for non-exec.

This is the first chapter of our 10 part blog series, Microsoft Partners Insights. Read chapter 2 - Financial Review for an Insight into the Financial information of the UK's top SME Microsoft Partners - revenue, profit & more.

About IT Leaders

Established in 2012, IT Leaders is a networking group of CEOs and shareholding leaders of predominantly Microsoft Partners who come together to collaborate and learn from each other.

All participants are senior leaders or the singular leader of their business which creates a rich environment for discussion, comparison, problem solving and learning about the personal, shareholder and commercial considerations they face. Many have aspirations to grow and realise equity value. Some, during their time within the group, have realised that ambition and are now encountering a different set of opportunities and challenges. This evolution adds to the potential within IT Leaders as experiences and lessons are shared and compared.

IT Leaders are mainly clustered around various aspect of the Microsoft technology stack – some are leaders in a singular specialism, others offer a broader spectrum of expertise, most offer managed services of one type and some are entirely managed service providers. Many in the group develop IP either as part of their service or as software developers. The businesses range in size, headcounts averaging between 15 and 100, revenues between £5m an £15m, with outliers either side. The two things all participants have in common is an eagerness to learn and a driving ambition for success.

The group conducts annual benchmarking surveys to track and compare progress, pay scales, investment appetite, and their quarterly meetings involve discussions on current market conditions and topical industry issues.

IT Leaders has spawned additional meeting groups, one for sales leaders and another for technical and operational leaders. These additional groups have the exact same ethos and set-up and the connections established in the original CEO forum add value and understanding to the other groups and vice versa.

IT Leaders is a growing and thriving small institution of like-minded people. It operates by mutual contribution and consensus and is facilitated by Shaun Frohlich.

About Shaun Frohlich, Founder of Incredible Results

With over 38 years of industry experience, Shaun is a well-respected figure amongst the IT leadership community and has spent the past 10 years helping people to shift their mindset from working on the business to realising growth potential and value from the business.

His ability to inspire and equip others to create incredible personal and professional change is borne out of his own experiences – good and bad – in founding, growing, buying, transforming, investing in and selling IT businesses.

Shaun founded Bytes Technology Group in 1982 and Bytes Recruitment in 1997 and in 1999 successfully sold both via a trade sale before exiting in 2000.

Following an interim management role at the early cloud services provider, Attenda, he led a buy and build strategy initially buying IT reseller Teksys, transforming the original business to create a software and services company, and more than doubling its revenues in 5 years via a combination of acquisitions and organic growth.

After exit via trade sale in 2008 Shaun joined the leadership team at Microsoft as the director that led the partner channel. Shaun left Microsoft in 2012 to do what he has been doing ever since, helping IT businesses owners grow and realize equity value.

In the past 8 years this has led to over 20 transactions comprising a mixture of MBO’s partial and full exits.

About Coeo

Coeo are a trusted data partner, and for many years have helped Incredible Results collect, analyse and gain insights from annual survey data. They use Azure to host and report on the insights from this Microsoft Partner research.

Coeo were the first Microsoft Partner globally to be awarded with the prestigious Analytics on Azure Advanced Specialization. They also hold the Windows Server and SQL Server Migration to Azure Advanced Specialization and Microsoft Gold Partner status... so you can rest assured that your data estate will be in a safe pair of hands.

Coeo help businesses realise their full potential through better use of data. Since 2007, they have specialised in the Microsoft Data Platform and Analytics solutions with extensive knowledge in the finance, retail and technology industries.

Data is at the core of what Coeo do. Their expert team hold more Microsoft certifications than any other data platform specialist in Europe and are passionate about sharing their knowledge and expertise to help their clients become industry leaders.

Coeo works with clients to create the most appropriate technology strategy for their business and provide mission-critical support as and when they need it. They are experts in architecting, optimising and migrating mission critical transaction processing systems. They accelerate deployment of enterprise class business intelligence solutions that win business confidence and deliver insight.

About Emily Frohlich

A psychologist by background, Emily has over 15 years’ experience developing talent and driving performance in organisations, leaders, and teams.

She has a Masters in Organisational Psychology and her work focuses on helping businesses understand and get the best from their people and customers.

Emily worked for business psychologists Nicholson McBride for 13 years, including 8 as a Client Director, before becoming an independent coach and consultant in 2019.

As well as conducting client and stakeholder research such as the IT Leaders Survey, Emily is retained by EY as a Senior Executive Coach for central government where she works with senior leadership across multiple departments.

Emily has extensive experience working with global law firms, as well as in investment banking, private equity, management consulting, and in the public sector.

At the heart of her approach is a focus on understanding behaviour and developing effective working relationships. Her work includes executive and board coaching, organisational change, leadership development, and research.

Clients Emily has worked with recently include: Allen & Overy, Bank of England, Baird Asset Management, BCLP, Clyde & Co, EY, Fidelity International, HM Treasury, Home Office, Judicial Board, Ministry of Defence.

Learn more about the IT Leaders group

|

||

|

%20(1).png?width=100&name=Kocho%20100%20width%20(2)%20(1).png) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Read the next chapter

Read chapter 2 - Financial Review for an Insight into the Financial information of the UK's top SME Microsoft Partners - revenue, profit & more.

Do you have a legal question for us?

Whether you are just getting started, need a template package or just some legal advice for your business, we are here to help with any questions you may have.

Our mission is to help you succeed, with less risk.